Citco’s Complexity Corner: Payouts picking up? Latest figures show private markets distribution drought could be at turning point

Private markets distributions have been in the spotlight for the wrong reasons in the last few years, but there are increasing signs that we may be at a turning point.

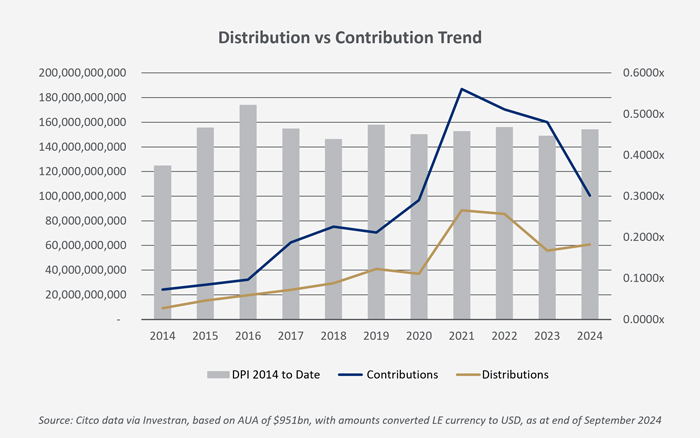

Having been on an upward trend for much of the previous decade, distributions have faced headwinds from the higher interest rate environment which began in 2022, culminating in last year’s so-called distribution drought. How bad was this drought? Citco data shows that distributions dropped sharply in 2023, down some 31% year-on-year, with distributions to paid in capital (DPI) shrinking to 0.3484. The ratio was the lowest seen for any single year over the last decade.

The good news is, the drought could be over. In the first three quarters of 2024, we have already seen a sharp reversal in DPI across our clients1. The current DPI for 2024 is at 0.605, and furthermore YTD distributions have already surpassed 2023’s full year total, sitting at almost $61bn.

Looking across the last decade to date on a cumulative basis, YTD DPI has risen back to 0.463 times, ahead of the 0.4473 times it dropped to last year, and ahead of the long-run average of 0.457 times.

Are these statistics alone enough to declare a turning point? DPIs can be inflated by various other means, including GP secondaries and continuation vehicles, for example, or via the use of leverage at a portfolio company level. This data is also only a snapshot so there may be some nuances versus the wider market.

Nonetheless, and even in the context of lower contributions, the data is still pointing to a general upswing, and while we will need to see full year numbers to make bolder claims, there is clearly a change in direction versus last year.

What is the outlook from here? Falls in interest rates in key markets such as the US have boosted confidence in the second half of 2024, and further expected cuts in 2025 could help continue to create a more favourable environment for private markets. But there is also another important trend at play here which further hints at a brighter 2025. Commitments, on a like for like basis, have continued to rise, albeit more slowly than the previous year, with Citco data showing a 7% increase in commitments (to end of Q3) this year.

We have seen persistent commitment growth over the last decade, and this further suggests that, despite last year’s dip, the drivers of growth in private markets have not been derailed.

1 Data is calculated across almost 200 clients via Investran, based on AUA of $951bn, with amounts converted LE currency to USD, as at end of September 2024

CITCO’S COMPLEXITY CORNER – UNPICKING THE ADMINISTRATIVE CHALLENGES FACING PRIVATE MARKETS

In today’s fast-moving Private Markets sector, complexity is everywhere. The demand for Private Markets investments has increased, with a broadening of interest across the investor base. This has had the knock on impact of increasing demand for more innovative processes and structures to meet the needs of existing and new GPs and LPs in the market. The result is solutions that are more complex than ever, meaning Private Markets managers and their asset servicer partners face new administrative demands. Citco’s Complexity Corner seeks to analyze these emerging challenges and discuss potential solutions to tackle them.

Explore more in this series

-

Citco’s Complexity Corner: Retailization in private markets - how can funds access private wealth more efficiently?+ + -

Interest in private markets has soared in recent years, with assets under management climbing above $13trn in 2023, having grown at almost 20% per annum since 2018. Numerous forecasts predict growth rates are set to accelerate further, with private equity expected to near double in assets under management (AUM) over the next four years, and private debt set to more than double in the same timeframe.

-

Citco’s Complexity Corner: How to reduce reporting timelines in private markets+ + -

The sharp increase in private markets funds in recent years has led to an increased focus on quality data that is delivered more quickly, is more granular, and is transferred via Application Programming Interfaces or other automated tools in a more secure format.

-

Citco’s Complexity Corner: Five ways managers can enhance the experience for end investors in private markets+ + -

Increasingly fierce competition for capital among Private Markets investment managers means that, in recent years, the end investor experience throughout the investor lifecycle has become a differentiating factor. In addition, the broadening of the investor base in Private Markets has tested the scalability of existing processes, and deploying appropriate technology to help maintain the investor experience is now a key component of any solution.